Binance Smart Chain (BSC)

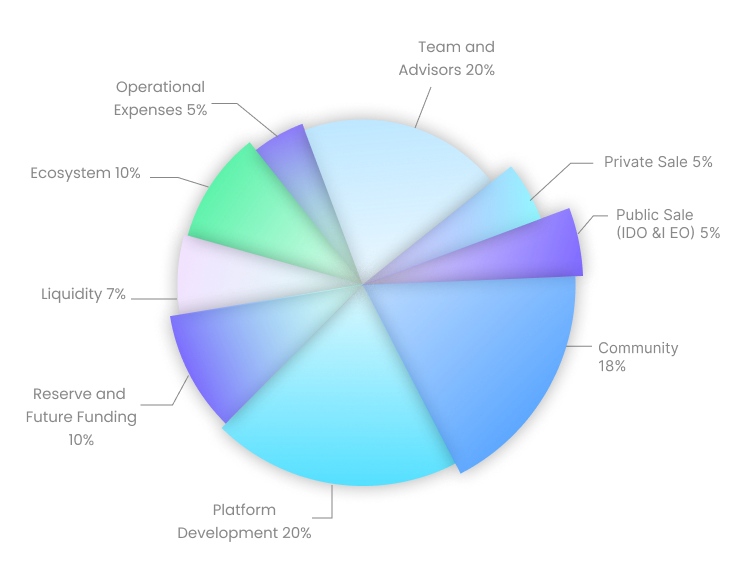

Orina's tokenomics framework is meticulously designed to establish a solid foundation for the platform's growth, ensuring fairness, community engagement, and responsible distribution. The token allocation and distribution plan is as follows:

Funds allocated to operational expenses are intended to support the day-to-day functions of Orina, including marketing, maintenance, and administrative costs. This ensures the ecosystem's stability during its early stages of development.

This allocation ensures adequate liquidity in the market for trading ORI tokens, enhancing their accessibility and usability. Robust liquidity supports a healthy token market, enabling seamless transactions for participants.

Tokens sold during the presale provide early funding for the project and bring onboard strategic supporters. This allocation facilitates the initial growth of Orina by securing the necessary capital for development and expansion.

The public sale provides the community with access to ORI tokens. Funds raised through the Initial Exchange Offering (IEO) will be used to scale the platform and execute the roadmap effectively.

The public sale provides the community with access to ORI tokens. Funds raised through the Initial Exchange Offering (IEO) will be used to scale the platform and execute the roadmap effectively.

This allocation is dedicated to developing and improving the Orina platform. It covers technical infrastructure, product scalability, security upgrades, and new features, ensuring Orina evolves to meet user needs.

These reserved tokens provide financial flexibility for long-term stability, unforeseen circumstances, and future growth opportunities. The fund acts as a safeguard for the sustainability of Orina.

This fund supports ecosystem expansion efforts, including strategic partnerships, global integrations, and collaborations that enhance the reach and value of the Orina platform.

This allocation is reserved for the core team and advisors. It ensures long-term alignment, rewards commitment, and motivates the contributors to drive Orina’s vision forward sustainably and responsibly.

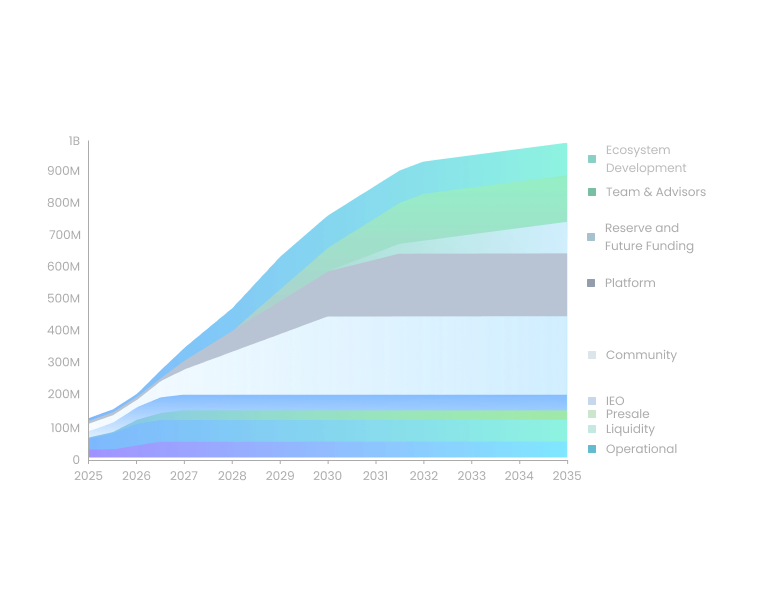

Allocation and vesting schedule ORI utility token IEO is planned for MAY 2025. It will be available on Pancakeswap (other DEX/CEX TBD) with a tentative price of $0.015 for 1 ORI. News and key details of the presale rounds preceding IEO will be available through the official media channels.

[email protected]

Empower your agricultural journey with the Orina App - your gateway to direct transactions, transparent sourcing, and sustainable farming.

Discover the decentralized power behind Orina's agricultural and e-commerce ecosystem.

Dive into the world of smart contracts and learn how they power the Orina ecosystem.

ORI isn't just a token; it's your key to a utility-rich ecosystem. Experience its power in driving transactions, rewards, and meaningful interactions.